Understanding Buying and Short Selling: Key Differences in Stock Market Strategies

In the world of investing, you might hear two strategies tossed around often: buying and short selling. At first glance, these might seem like just two sides of the same coin, but they actually represent distinct approaches to the stock market, each with its own set of risks, rewards, and strategies. While buying stocks is a straightforward method, short selling introduces a more complex concept of profiting from stock price declines.

Whether you are just starting or looking to expand your knowledge, you need to understand the difference between these two approaches to navigate the market best. This article breaks down how each works, the risks and rewards, and what the approach suggests about strategy for investors like you.

Understanding the Basics

Before delving into the nitty-gritty, it's crucial to first know what buying and short selling means on a general level. Buying stocks is simply going long. This is the most classic way of investing. In a nutshell, buying a stock simply means buying a share in a company. The idea is that if the company does well, the price of the stock goes up, and you can sell your shares at a profit.

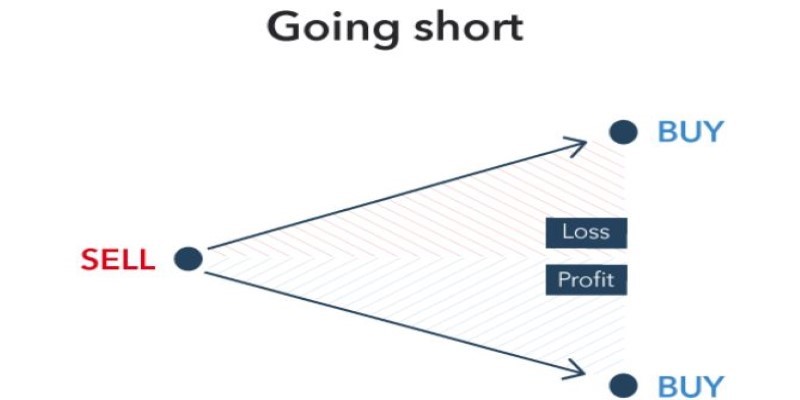

On the other hand, short selling is a strategy that investors utilize when they anticipate that the value of a share will go lower. Unlike a buy, you are hoping for the stock price to rise, while short selling allows you to borrow shares to sell them at current prices with hopes of buying those shares back in the future for a lower amount. It's a strategy that can fetch immense profits if the stock price plummets down, but, at the same time, it comes with a pretty high risk level if the stock price surges instead.

How Buying Works in the Stock Market?

When you buy stocks, you are essentially investing in the future success of the company. This is one of the methods preferred by investors because it is straightforward and perceived to be less risky compared to short selling. You buy shares and, as a result, become a part owner of the company. You expect that the value of the company will increase over time, which would raise the value of your shares. Well, if things go well, you will sell stock at a profit. The most common outcome is that the stock price will rise, providing you with a return on your investment.

shoot up, and you receive your amount return.

The key advantage of buying stocks is that, in theory, there’s no limit to how high the stock price can go. The more successful the company becomes, the higher the price of your shares. Of course, the downside is that if the company does poorly and the stock price falls, your investment loses value. However, the losses are generally limited to the amount you invested; if a stock price goes to zero, that’s the maximum loss you can incur.

The Mechanics of Short Selling

Short selling operates quite differently. In short selling, you anticipate that a stock's price will decline. Here's the process: first, you borrow shares of a stock from a broker. You then sell those borrowed shares at the current market price, intending to buy them back later at a lower price. If the stock price does fall, you can buy the shares at the reduced price and return them to the lender, capturing the difference as profit.

For example, if you short-sell 100 shares of a stock at $50 per share, you’ll receive $5,000. If the stock drops to $40 per share, you can then buy back the 100 shares for $4,000, return them to the lender, and make a profit of $1,000. But if the stock price rises instead of falling, the losses can accumulate quickly. If the price increases to $60 per share, you would need to buy back the shares for $6,000, resulting in a $1,000 loss.

Comparing the Risks and Rewards

The risks and rewards of buying versus short selling are stark. Buying stocks is generally seen as the safer option because the maximum loss is limited to the amount you invested. Over time, stocks tend to appreciate, especially for companies with strong growth potential, although there are no guarantees. Historically, markets have trended upwards, making long-term investments in solid companies a reliable strategy for most investors.

Short selling, on the other hand, carries significantly higher risk. In this strategy, there is no limit to how high a stock’s price can rise, meaning potential losses can escalate quickly. If the stock price increases instead of falling, short sellers may find themselves having to buy back shares at much higher prices, resulting in substantial losses. In extreme cases, these losses can even exceed the initial amount received from selling the borrowed shares. This unlimited downside risk is why short selling is typically reserved for more experienced investors with a strong understanding of market movements.

While short selling can be risky, it offers the potential for quicker rewards. Investors who believe a stock is overvalued can profit from its decline by short selling. This strategy can be particularly attractive during market downturns or when specific stocks are expected to fall. However, because the broader stock market tends to rise over time, short selling is considered a more speculative and advanced strategy. It requires a higher tolerance for risk and a keen insight into market dynamics to be successful.

Conclusion

Both buying and short selling are distinct strategies in the stock market, each with its benefits and risks. Buying stocks is generally simpler, focusing on long-term growth with limited downside risk. It suits investors who want to profit from a company's success. Short selling, however, is a riskier strategy that allows investors to profit from declining stock prices but can lead to substantial losses if the stock price rises unexpectedly. Ultimately, the choice between buying and short selling depends on individual goals, risk tolerance, and market conditions, making research and caution essential for successful investing.