What's Your Retirement Spending Strategy? A Complete Guide

Planning how to spend your money during retirement is important to make the most of your savings and enjoy life comfortably. Everyone’s retirement looks different, and having a clear strategy can help you stay on track with your financial goals. Whether you plan to travel, explore hobbies, or focus on family time, understanding your spending needs and creating a budget is key. This guide will walk you through simple steps to create a smart retirement spending plan that works for you.

Understand Your Retirement Goals

A spending strategy needs to be developed first after establishing clear retirement objectives. The money budget also accommodates major retirement dreams including travel plans and an extra home and smaller delights including starting a new hobby or providing financial fun to your grandchildren. You need to spend time thinking about things bringing you happiness and thinking about your ideal retirement existence.

After defining your retirement dreams you should identify all related expenses that will contribute to their fulfillment. The expense for extensive travel during retirement needs consideration of flight costs alongside accommodation costs alongside activity expenses in different locations. Research the material requirements as well as classes for any new hobbies that you wish to pursue in your retirement planning.

Calculate Your Retirement Income

Your retirement income will determine how much you can afford to spend during retirement. This can include sources such as social security, pension plans, investments, and rental properties. It's important to have a realistic understanding of your expected income in order to plan your spending accordingly.

If you're not sure how much income you'll have during retirement, there are various tools and calculators available online that can help you estimate. You may also want to consider consulting with a financial advisor for personalized advice on your specific situation.

Identify Your Necessary Expenses

Next, make a list of all the necessary expenses you anticipate having during retirement. This can include housing costs, healthcare expenses, transportation, insurance premiums, and taxes. These are the essential expenses that you'll need to cover in order to maintain your quality of life.

Be sure to also take into account any existing debts or loans that you may still be paying off. It's important to factor these into your budget and make a plan for paying them off before or during retirement.

Consider Your Discretionary Expenses

After accounting for necessary expenses, it's time to think about discretionary spending – the non-essential purchases and activities that bring enjoyment but can also quickly add up. This may include dining out, travel, entertainment, hobbies, and gifts for loved ones. While these expenses are not essential, they can greatly enhance your retirement experience.

It's important to be realistic about how much you can afford to spend on discretionary expenses. This is where having a clear understanding of your income and necessary expenses comes in handy. You may need to make adjustments or prioritize certain discretionary expenses over others.

Create a Budget

Now that you have a comprehensive list of your goals, anticipated income, necessary and discretionary expenses, it's time to create a budget that works for you. Start by setting a total spending limit for each month or year based on your expected income. Then allocate this amount towards various categories such as housing, healthcare, transportation, and so on.

Be sure to leave room for unexpected expenses or emergencies, and regularly review and adjust your budget as needed. Sticking to a budget can help you stay on track with your financial goals and ensure that you have enough funds to cover all of your needs and wants during retirement.

Adjusting for Inflation and Longevity

One important factor to consider when creating a retirement spending strategy is inflation. As the cost of living increases over time, your expenses will also rise. It's important to account for this in your budget by factoring in a reasonable amount of inflation each year.

Be Open to Changes

It's important to remember that your retirement spending strategy is not set in stone. Life circumstances can change, and it's important to be open to adjusting your plan accordingly. This could include changes in income, necessary expenses, or even personal preferences.

Regularly reassessing your spending strategy can help you make the most of your savings and ensure that you're still able to achieve your retirement goals. It's also helpful to have a contingency plan in case of unexpected events, such as market downturns or health issues.

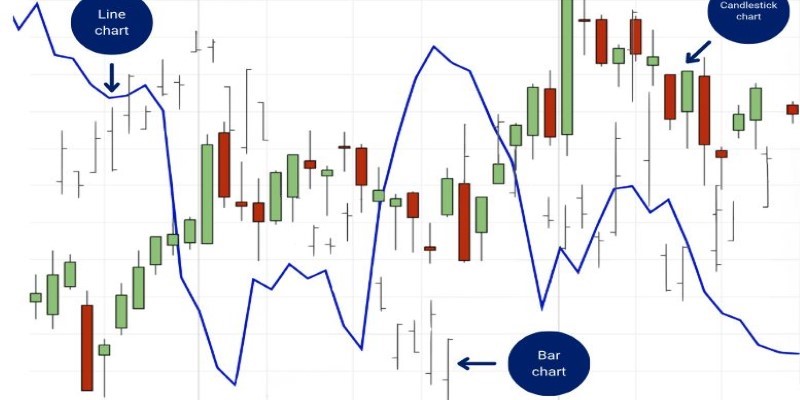

Managing Investments in Retirement

Managing your investments during retirement is another important aspect of your spending strategy. It's important to have a diversified portfolio that can generate income while also managing risk. This may include a mix of stocks, bonds, and other assets.

It's also important to regularly review and adjust your investment plan as needed. As you age and approach retirement, it may be wise to shift towards more conservative investments to protect your savings.

Seek Professional Advice

Creating a retirement spending strategy can be overwhelming, and it's okay to seek help from professionals. A financial advisor can provide personalized guidance based on your specific situation and help you make informed decisions about your retirement finances.

It's also important to regularly review and update your plan with the help of a professional. As you near retirement age, it's especially beneficial to work with an advisor who can help you ensure that your savings will last throughout your golden years.

Conclusion

Having a solid retirement spending strategy is crucial for enjoying a comfortable and fulfilling life after leaving the workforce. By understanding your goals, income, expenses, and investments, you can create a budget that supports your lifestyle while also preparing for unexpected events. Regularly reviewing and adjusting your strategy, seeking professional advice when needed, and being open to changes can all help you make the most of your retirement savings. So start planning early and make sure your golden years are everything you've dreamed of.