Cash Secured Puts: A Conservative Strategy for Profitable Investing

Investing can feel overwhelming, but some strategies simplify risk management while still generating income. Cash-secured puts are one such approach, allowing investors to collect a premium in exchange for agreeing to buy the stock at a set price if it drops. It's a practical method for those who want to earn while waiting for a favorable entry point. Unlike riskier options strategies, this one is more conservative and suits investors who actually want to own the stock.

Options trading, people often think, carries a high degree of risk. Not for a cash-secured put, however. It is a method for producing cash flow while still positioning for the potential acquisition of stock. Though profitable in this sense, it still carries considerable risk. A proper understanding of how it works needs to be absorbed before this can be pursued, being sure that it fits within your long-term goals.

How Cash Secured Puts Work?

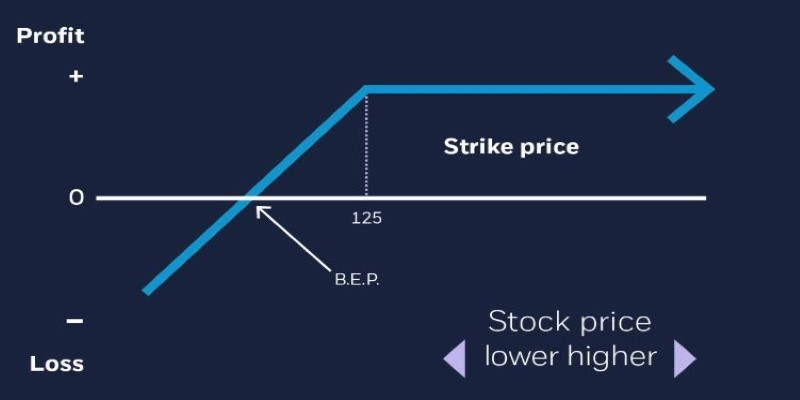

A cash-secured put is an option contract in which an investor promises to buy the stock at a specified price at a specific point in time when the stock should fall to that level before expiration. For agreeing to do that, the investor receives a premium, an amount paid in advance for assuming that obligation. The term "cash-secured" means the investor has enough cash set aside to buy the stock if the option is exercised. This reduces risk compared to other options strategies that involve leverage.

Here's how it plays out in real life. Suppose you want to own shares of a company that is currently trading at $50, but you feel the price is a bit too high. Instead of buying now, you sell a cash-secured put with a strike price of $45. For this, you receive a premium—say $2 per share. In the meantime, if the stock price stays above $45 until expiration, you let the put option expire worthless, and you are left holding the premium as profit. But if the stock falls below $45, then you are obligated to buy it at that price, no matter how far down it actually falls. The good news is you have already been paid for taking that risk, so your effective purchase price is really $43 ($45 minus the $2 premium).

This approach works best when you're happy with the idea of owning the stock. Unlike speculative traders who aim to profit from price swings, cash-secured put sellers use the strategy to generate income while positioning themselves for a potential stock purchase. The worst-case scenario is ending up with shares at a price you were willing to pay anyway.

Why Do Investors Use Cash Secured Puts?

Investors like this strategy because it serves two main purposes: generating income and acquiring stocks at a discount. For those who want steady returns, selling cash-secured puts can be a consistent way to collect premiums, especially in a stable or slightly rising market. Since the investor is taking on the obligation to buy stock, the premiums received can act like extra income while waiting for the right price to buy.

Many investors use this approach as part of a broader portfolio strategy. For example, long-term investors who follow a value investing approach may prefer this method instead of placing a traditional limit order. A limit order sits in the market, waiting to execute at a specific price, but it earns nothing while waiting. Selling a cash-secured put achieves the same goal of buying at a preferred price but also generates income in the process.

Another reason investors like this strategy is that it allows them to take a disciplined approach to buying stocks. Instead of reacting emotionally to market swings, they set clear price targets and waited patiently. The premiums collected over time can also help offset occasional losses. Even if a stock price doesn’t drop enough to trigger the purchase, the investor still benefits from the premium collected.

However, there are risks to consider. If a stock’s price falls sharply due to bad news or economic downturns, an investor might be forced to buy it at a higher-than-market price. While they still own shares, the immediate loss can be significant. That’s why this strategy works best with solid, well-researched stocks that the investor is comfortable holding for the long run.

Managing Risk with Cash Secured Puts

While cash-secured puts are generally safer than other options trading strategies, they still carry risks. The biggest risk is ending up with shares of a company that declines in value after assignment. If the stock price falls far below the strike price, the investor has to buy it at a loss, even after factoring in the premium received.

One way to manage risk is by choosing stocks carefully. Investors should focus on companies they genuinely want to own, not just any stock that offers a high premium. It’s also important to select strike prices that align with a reasonable valuation, ensuring that the purchase price remains attractive even in a market downturn.

Investors can monitor market conditions and adjust strategies accordingly. If they no longer want the stock, they can close the position by buying back the put option, possibly at a loss. Alternatively, they may roll the position by buying back the original put and selling a new one with a later expiration, extending the strategy and collecting premiums.

Cash-secured puts are most effective in stable or slightly bullish markets. In highly volatile markets, the risk of assignment increases, and sudden price drops can lead to unwanted stock positions. That's why investors should always have a plan before selling puts, ensuring they have the capital and willingness to follow through if assigned.

Conclusion

Cash-secured puts offer a way to earn income while setting up a potential stock purchase at a lower price. This strategy is ideal for investors who want to buy stocks but prefer collecting premiums while waiting. While it carries some risk, careful stock selection and risk management can make it a valuable tool. By staying disciplined and patient, investors can use cash-secured puts to enhance their returns, reduce costs, and take a more strategic approach to long-term investing.